The Northeast is an economic powerhouse. It includes the global capital of finance, more than half of the world’s top pharmaceutical companies, 200 universities, leading medical institutions, centers of media and telecom, and more. Yet its third-party data center ecosystem is lackluster. It falls short in quantity, quality, and value.

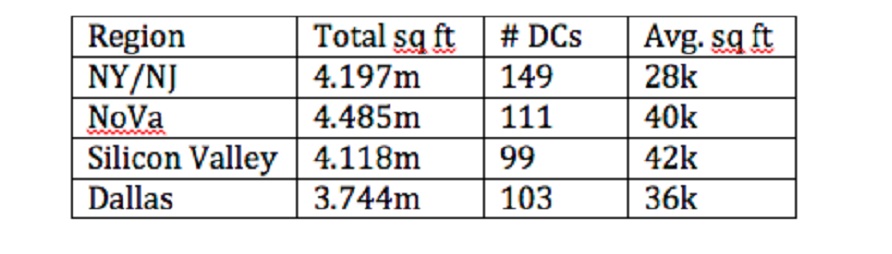

Colocation (colo) data centers in the Northeast’s metro areas represent only about 10% of the total in the U.S., despite the region driving more than one-fifth of the national economy. Data centers in the core NY/NJ market also are smaller than those in the other three major markets (Table 1). Smaller translates into older facilities with fewer features and less room for growth. At the same time, northern New Jersey and Boston are among the most expensive data center locations in the U.S.

The market is adjusting to limited supply and growing demand. Planned additions to capacity in the region are outpacing similar activity in other expansion markets.1 But the question remains: Will these investments deliver what the region needs and move it from its “colo hotel” past into an advanced data center (ADC) future?

ADC DEFINED

Led by financial, health care, biomedical and life sciences, telecom, cable, advertising, higher education, and other industries, the Northeast economy needs data centers that enable these sectors to meet their unique IT requirements. At a higher level, it simply needs the superior performance of ADCs, embodying these attributes:

• Availability. Guaranteed levels of compute and storage, translated as minimal downtime, and specified by a given service-level agreement (SLA)

• Security. Defined in physical terms by levels (perimeter, entrance, floor, rack, etc.) and various processes; site location may also play a role

• Connectivity. Hallmarks include carrier-neutral telecom connectivity, diverse fiber feeds, and options for additional network build-outs

• Redundant power. Not just backup, but industrial-grade, dedicated, and customizable power connections with built-in redundancy and upgrade capacity

• Size, plus scale. Flexible space and power profile are indicators, along with right-sized capacity and the ability to handle “web-scale” growth

• Efficiency. Reaching the highest power usage effectiveness (PUE)2 while operating at scale requires advanced energy-efficient design

• Services. ADCs may offer cloud, network and application management services, including customized application environments

Those attributes are common to the massive data centers built by leading web companies. Some multi-tenant data center (MTDC) operators have become fast followers of these leaders, if not pacesetters themselves. The rapidly expanding, Switch-owned SuperNAP in Las Vegas, for instance, was pioneering massive scale and high-density seven years ago. The feature-rich ADC model sells.

According to the Uptime Institute, the top-three criteria that IT practitioners have in mind when assessing external data centers are availability, security, and connectivity. When choosing a data center, they focus on the ability to scale up, reduce costs, and accelerate deployments.3 Interest in ADC-like performance is clear. How best to respond in the Northeast, a region marked by high costs and limited facilities?

DATA CENTER INNOVATION

Innovation is one answer. Here are four ways that MTDC operators can deliver the performance and cost structure needed to move this regional market.

Prefabricated, modular architecture. Data centers have typically required acquiring a huge building, adding power and cooling, and then dividing it into halls or rooms or wire cages. An alternative is to acquire a facility and then use modular infrastructure components, built to the specifications of particular customers. This technique accelerates deployments, conserves capital, and future-proofs the asset, enabling a data center operator to outfit a containerized vault with one system today, and then switch it out later as circumstances change.

Power density. A related area involves packing more power into a given area. Improved power density means more servers per rack, which generally translates into better efficiency. Virtualization, blade servers, and micro servers are driving this trend. Yet as density rises, so too does the need for more cooling. Containment and more diffuse workloads are conventional techniques, but only go so far. Modular infrastructure enables operators to deliver the precise amounts of power required, contributing to higher power density.

Site location. Another answer is new thinking on where to build or locate your facility. The old model was centered on colocation sites, the well-known, downtown addresses for telecom interconnects. Colocation is critical, but making it the anchor of a data center incurs opportunity costs. Placing a data center outside of a city, but in close proximity to fiber backbones, gives one robust links to any number of “colo hotels.” The right site could also provide vast capacity, over-abundant power resources, and fortress-like campuses that defy natural or man-made disaster.

Customized services. As organizations assess how much of their data center infrastructure to maintain and what to outsource, they are looking for increasingly custom-fit and nuanced solutions. The future of multi-tenant data centers entails providing a broad portfolio of services, such as: equipment transition and migration, planning, deploying and managing wide area networks; supporting standard communication tools; and optimizing infrastructure for any number of industry-specific applications.

THE SMART ADC FUTURE

Analysts are predicting that over the next five years, millions of enterprises worldwide will move their servers off premises. In the Northeast, that could amount to tens of thousands of leases for MTDC operators, with highest value going to those that adopt the ADC model.

Keystone NAP, an ADC within driving distance of Boston, New York, Philadelphia, and Washington, DC is one such example. But the market should – and will – expand. Driven by innovative design, new logistical thinking and expanded services, a rising class of smart ADCs can both reduce costs and raise standards, leading more businesses to entrust them with a growing share of their IT operations.

REFERENCES

1 .DCKB, 451 Research, “The Colocation Market,” Dec. 2014. The other three expansion markets are NoVA, Chicago, and Silicon Valley.

2. PUE is defined as the ratio of DC input power over IT load power.

3. “2014 Data Center Industry Survey,” Uptime Institute.com