Data is virtual — until it isn’t. The many terabytes of cloud data being generated every day have to reside on a server somewhere. With demand for both virtual and physical space soaring, finding the right location for data centers is becoming increasingly competitive. While the cloud may be everywhere, some data center locations are more strategic than others.

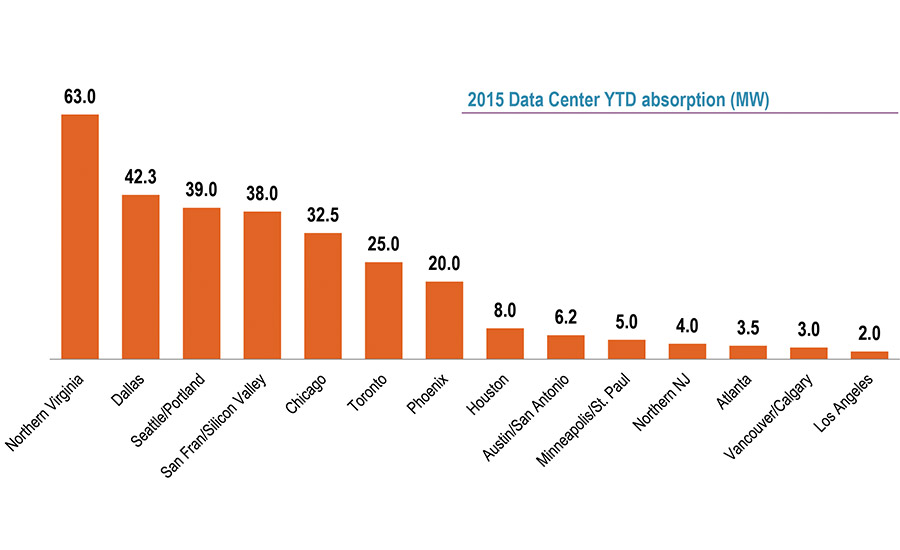

The data center market across North America saw tremendous growth in 2015, with multi-tenant data center (MTDC) providers in the United States alone earning revenues of $115.3 billion and experiencing 6.1% growth. Companies continued to outsource their IT platforms, lease third-party facilities and adopt cloud services, while many data center operators are evaluating upgrades to their facilities or scoping out new locations.

To help data center executives successfully navigate the North American data center market, JLL’s Data Center Perspective analyzes location trends in top and emerging cities for data centers, exploring dynamics as varied as utility rates and varying inventory on the West Coast to explosive economic and headquarter relocation growth in the South.

Data Center Demand Drivers

Increased adoption of the Internet of Things (IoT) and software-defined data centers, along with intensified focus on disaster recovery and security, is prompting corporate data center owners to consider public cloud and third-party data center solutions to reduce costs and improve access to current technologies. Netflix Inc., for instance, recently announced plans to shut down the last of its enterprise data centers, making it one of the first big companies to manage all of its IT remotely.

In 2014, an estimated 51% of all workloads were performed in the cloud. As demand surges, Cisco predicts that global data center traffic will triple by 2017 to 7.7 zettabytes, representing a compound annual growth of 25.0%, with the global market for cloud equipment reaching $79.1 billion by 2018.

In an emerging trend, the major telecommunications companies are continuing to shed their data center assets and business lines as they return to focus on core competencies. This will open up opportunities for MTDC providers hoping to expand in more competitive markets.

Whether their expansion strategies involve buying existing facilities or investing in construction of purpose built facilities, data center operators can benefit by identifying the optimal location sites.

Where Is The Cloud, And Where Should It Grow

The biggest must-haves on any data center location list are low operating costs and enormous bandwidth. Other important factors include tax incentives and, for third-party operators, access to potential clients with complex data needs. Providers are increasingly looking to minimize development and operating costs when assessing where to locate major data centers.

Other very important factors include energy costs and tax incentives and, for third-party operators, access to potential clients with complex and growing data needs.

To narrow the field, data center executives should consider a few fundamentals as they seek the next great place for data storage:

Search for low-cost energy and renewable power sources. Energy is a major cost factor in data center operations and one reason that data center clusters are cropping up in new locations. For example, though Los Angeles is a much larger overall market, Phoenix has become a popular alternative in the Southwest because of comparatively low utility rates averaging $.062/kWh. An abundance of power from renewable resources, including a major solar power plant in Reno, and large wind farm developments in Texas, has attracted some major technology companies to evaluate powering their data centers with 100% renewable energy.

Chicago, NoVa, and Dallas/Fort Worth also boast low utility costs at $.045 to $0.067/kWh in 2015, along with excellent fiber and limited natural disaster risk. Meanwhile in central Washington, the high desert plain offers extremely inexpensive power averaging $0.025/kWh.

Look for attractive government incentives. Data centers are especially promising candidates for economic development incentives, delivering high paying and stable jobs in a growing industry. An Associated Press (AP) analysis of state revenue and economic-development records shows that government officials extended nearly $1.5 billion in tax incentives to hundreds of data-center projects nationwide during the past decade. Minneapolis and St. Paul offer some of the most aggressive tax incentives in the country, providing tenants of eligible colocation facilities with tax abatement on all power costs as well as a sales tax rebate on all hardware and software purchases. The Twin Cities have experienced a threefold increase in demand since 2013, which has attracted six new providers to the market in the last two years alone.

At least 23 states have incentives designed specifically for data centers, according to the AP report. Missouri recently passed legislation giving tax breaks to new data centers that involve at least a $25 million investment and 10 jobs; significant expansion projects are also eligible for tax breaks. More recently, Texas recently passed tax incentive legislation providing 100% exemption from sales tax on business equipment necessary for data center operation once thresholds for size and investment are met.

Prioritize proximity to businesses with significant data needs. Markets that offer the strongest demand growth typically possess a high concentration of tenants in sectors like energy, health care, finance, technology, and retail. DFW has seen a 100% growth in data center absorption in 2014 and 2015 over previous years due to explosive economic growth as a result of multiple headquarter relocations out of the West Coast and Midwest regions across various industry verticals. Silicon Valley, for example, continues to be a data center hotspot despite relatively high electricity rates at $.103 per kWh in 2015 and extraordinarily high rental costs, with turnkey rates of $165 to $175 per kWh across almost all wholesale providers.

Consider markets of choice for these industries in particular:

• Health care: As health care organizations seek data security and privacy, cloud services are gaining force. A 2014 Dell survey found that nearly all health care organizations were using or considering using cloud services in the near future. In the Twin Cities, for instance, 39% of user demand comes from health care. Atlanta and Northwestern markets such as Portland and Seattle also show strong health care user demand.

• Retail: In 2014 alone, U.S. retail e-commerce sales increased by 15.7%. Growing demand from this sector has been significant in some markets — retail and e-commerce users comprise 20% + of demand in Chicago, Silicon Valley, and Phoenix.

• Financial services: Nationally, financial services companies accounted for approximately 15% of data center revenue in 2014, according to JLL’s 2014 North America Data Center Outlook. The greatest market demand is found in Northern Virginia, DFW, northern New Jersey, and greater Toronto, where financial and banking institutions occupy significant data center real estate inventory.

• Technology: In Silicon Valley, real estate/supply options for data centers is extremely limited and demand for space has been robust this year, with local technology companies, mobile applications, and cloud requirements driving growth. Other markets with a well-established technology sector are Atlanta and Seattle and the Pacific Northwest, where over 30% of demand comes from technology companies.

Investigate underlying data center market dynamics. For users of third-party data centers, a market’s current rental rates are most meaningful when viewed alongside a host of other metrics, such as demand, net absorption, and construction underway or planned. For instance, in Chicago, a significant amount of absorption occurred in the fourth quarter of 2015 at aggressive rates due to available space that came to market — primarily in the suburbs — to meet growing demand. The area gets healthy interest from a variety of industries, but has been particularly attractive to West Coast technology companies developing latency-sensitive sites for cloud hosting strategies, whereas supply is extremely low, and demand remains high, in the Silicon Valley area, which is currently driving high rental rates.

Prepare for increasing demand and competition for the most strategic locations. Data center real estate is generally expected to remain tenant-favorable through mid-2016. However, as the market adjusts to higher demand, and third-party providers race to construct new supply, leverage will start shifting toward providers and rents will rise. Real estate opportunities in tightening data center markets will come from those telecom companies shedding data center space to return to their core competencies.

The key for data center owners and operators seeking to expand, relocate their facilities, or seek third-party solutions is to take a holistic look at the market map. With up-to-date insights on factors like electricity costs, available and under construction supply and industry demand, data center users and operators alike can pinpoint the optimal location for their next big play.