The short answer is that this result could happen in several situations, such as when a promise of savings is written in very general language and included within an equipment and services proposal to a facility owner: “We will save [your company] at least 20 percent in energy costs. The [equipment] will pay for itself within 3 years.” The proposal is incorporated into the contract.

The cost of energy rises. The project doesn’t deliver the cost savings expected by the customer. The customer notifies the seller to “pay up” on its guarantee. The seller responds, “We provided a 20 percent reduction in the facility’s use of electric power. The only reason you did not achieve more cost savings is that there was an increase in the cost of power. The facility responds, “We were promised energy cost savings.” Then the seller calls its lawyer who advises that ambiguous language is generally construed against the drafting party and that the Uniform Commercial Code (UCC) warranty disclaimer in the “General Conditions” of the seller’s contract only applies to warranties that are not stated. However, in this case, the proposal became a part of the contract and, therefore, was stated. The lawyer also advises that Article 2 of the UCC only applies to sales of goods, and the seller’s contract covers providing a combination of equipment and services to customers.

Results: the customer collects on the guarantee, and the seller restructures its contracting process and revises the General Conditions. The dangers of misunderstood guarantees cut both ways. In another situation, a customer relied upon a different type of energy savings guarantee. Like the above guarantee, this one also stated, “We will save [your company] at least 20 percent in energy costs. The [equipment] will pay for itself in three years.” The customer did not focus, however, upon the provision in the contract’s General Provisions, which stated that all guarantees and calculations of savings are based upon the cost of energy per kWh, kW or therm on the date of the contract.

In this second case, when the price of energy increased and the customer’s total cost of energy increased, the customer was unsuccessful in collecting under the guarantee. Although each of the above disputes had a different outcome, in each case the customer enjoyed increased savings benefits from the installed equipment as the price of energy increased. In each case, a poorly written guarantee resulted in a needless misunderstanding and a dispute.

LESSONS LEARNED

Energy savings guarantees should be written carefully, and attention should be paid by each party to the type of guarantee being offered. Guarantees are more than part of the pitch; they are a specific promise that, if Anatomy of an Energy Savings Guarantee The things that can go wrong Legal Perspectives Energy savings guarantees add a wrinkle: both parties may only find out what the guarantee covers when the customer claims that the energy-saving equipment did not deliver the guaranteed savings. 30 | Mission Critical September/October 2012 not met, can be the path to liability on the part of any seller and regret on the part of any customer that fails to understand the guarantee. In contrast to the simple examples described above, energy savings guarantees can be very complex and have many moving parts.

The following example is taken verbatim (except that the seller’s name is omitted and product unidentified) from an on-line brochure seeking to sell [units] to data centers.

“Save up to 78 percent on your Data Center Cooling energy, with a guaranteed three-year (ROI) Return on Investment... [Seller] Guarantees all its projects efficiencies. [Seller] will either purchase an efficiency insurance policy to protect your investment or establish a joint account for the customer that [Seller] will deposit a portion of the profit from the project into that account. When the efficiency and ROI of the project are validated by the customer’s third-party reviewer, those moneys [sic] will be distributed monthly through the first year to [Seller] Solutions. In the event that the efficiency measures and ROI do not meet the guaranteed levels, the customer receives the difference in operational costs per hour on any occurrence from that account for the first year.

In addition to the fact that this guarantee is difficult to understand, a number of questions and concerns, for both seller and customer, jump out from the above description of a guarantee that will require negotiation and, hopefully, resolution in the final signed contract. In the quoted language, the seller is putting the determination as to whether the CRAC unit performed efficiently and will achieve the guaranteed ROI entirely in the hands of the customer’s reviewer. Shouldn’t the third-party reviewer be required to be well qualified and apply specific review standards? Questions that a customer should ask might include the following: Is the (joint account vs. insurance) decision to be entirely in the seller’s hands, or does the customer have a say? If insurance, which party pays the premium? If a joint account, how are the seller’s profits to be determined?

What portion of the seller’s profit is to be deposited, and will there be a floor upon the amount of savings to be deposited? What withdrawal requirements will be imposed upon the account? How is the “difference in operational costs” to be calculated, and what is to constitute an “occurrence”? For these reasons, it would be difficult to interpret this guarantee if it were to be incorporated as-is into the contract. As noted above, any ambiguities would likely be construed against the seller. Energy savings guarantees can be important to equipment purchase guarantees and form the heart of shared savings agreements, energy performance contracts, and certain types of energy services agreements. Following are examples of certain types of energy savings guarantees:

1. Payments based upon deemed savings. While lighting is only a small percentage of a typical data center’s electrical load, sensor-controlled light-emitting diodes can provide significant reductions in electric demand and consumption when compared to fluorescents. LEDs also produce less heat than fluorescents. The cumulative beneficial effects of an LED retrofit can improve a data center’s power usage effectiveness factor (PUE). Since the delta between the power requirements of the units to be replaced and the new lighting units can be projected (wholly or partially) in advance based upon manufacturers’ specifications and data, the energy savings to be produced by lighting retrofit projects is sometimes determined by stipulating in advance (deeming) the level of savings to be achieved by each luminaire to be used for the purposes of calculating energy savings. The following is an example of a portion of a deemed savings provision: •

- Baseline consumption. Electrical demand and electric energy consumption will be stipulated for each baseline lamp/ballast fluorescent combination based on the manufacturer’s rated consumption and demand for each lamp/ballast combination.

- Energy savings calculation. Electric energy and demand savings will be calculated as the difference between the baseline for each luminaire and the manufacturer’s data for each sensor-controlled LED luminaire’s electric energy demand and consumption, adjusted for the percentage of dimming time recorded by the LED control system. Total energy savings will be calculated using the electric energy and demand savings for each luminaire (calculated as provided herein) multiplied by the operating hours and actual luminaire counts. The above example shows how the savings calculation is to be performed. Of course, there are several other factors that have to be addressed such as a spot comparison between the manufacturer’s data and field experience and possible limitations upon dimming records. 2. Payments based upon achieved savings. The following is a type of guarantee that puts the burden squarely upon the seller to produce savings based upon measured savings multiplied by an “index” price that changes, subject to a floor price, throughout the term based upon the actual cost of electric commodity to the customer:

- Electric commodity. The unit price per kWh to be used to determine electric commodity savings with respect to each month following the commencement date shall be the same as the price per kWh charged to the owner by the utility during that month under account: (or successor account having the same utility service classification). During the term, the electric commodity unit price shall not be less than the unit price per kWh for said account charged to Owner with respect to the first month following the commencement date. [Note: The contract has similar provisions for electric demand and natural gas].

-

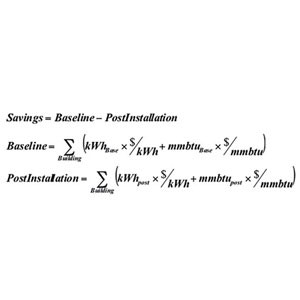

Energy and cost savings calculation algorithms. The company shall base its calculations of savings upon the following examples. The company may use other reasonable algorithms or methodologies to calculate savings with the owner’s advance written permission, which may not unreasonably be withheld: